L&E Course #7: The dollars and cents of Web3

- Mar 1, 2023

- 9 min read

As they say, “money makes the world go round,” and money will make Web3 go big. In 2022, Web3-related investment funding amounted to USD 7.1 billion. Topping the list is the category of gamification (USD 4.5 billion), followed by Metaverse investments (USD 1.8 billion) and social networks (USD 259.1 million).

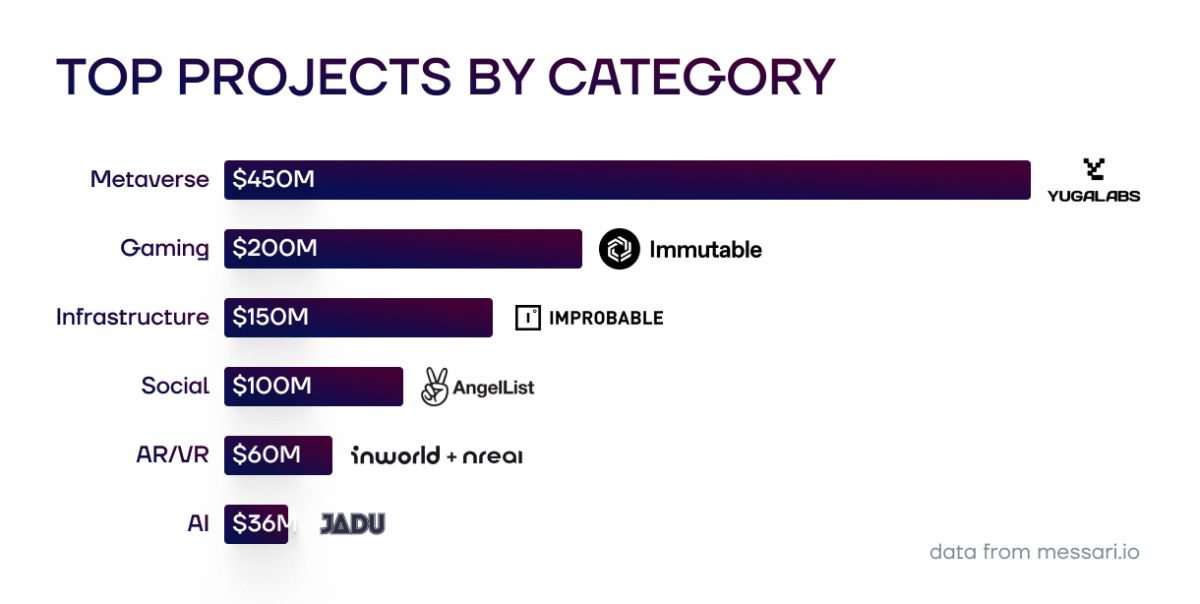

Regarding individual projects, the top-grossing fundraising action took place in the Metaverse category, where the proprietor of the Bored Ape Yacht Club (BAYC) franchise, Yuga Labs, raised over USD 450 million in 2022. Coming in a distant second is blockchain gaming developer, Immutable, who raked in over USD200 million throughout 2022, followed by blockchain infrastructure service provider, Improbable, who collected over USD150 million last year.

Top Investments Grossing Web3 Projects in 2022 (Source: MPost.io)

Top Investments Grossing Web3 Projects in 2022 (Source: MPost.io)

It always feels good to be part of a cause bigger than ourselves. One way to be part of Web3 projects is by participating in crypto crowdfunding. In essence, the concept of crypto crowdfunding entails raising money from the public through the issuance of cryptocurrencies.

Types of Crypto CrowdfundingThe genesis of crypto crowdfunding started with Initial Coin Offering (ICO). The first ICO was that of Mastercoin (MSC). The ICO for MSC, which was held in July 2013, lasted for about a month and raised over USD 750k worth of Bitcoin (BTC). The proceeds were used to establish the Mastercoin Foundation, which has since been rebranded as Omni Layer.

For a few years following the introduction of the concept by Mastercoin, there was a boom in ICO. The boom peaked in early 2018 when ICOs raised a total of USD 6.3 billion in the first three months alone. This amount was a 118% increase from the ICO proceeds for 2017. Alas, ICO became a victim of its success as fraudsters hijacked it. By August 2018, a report found that 80% of ICOs were scams.

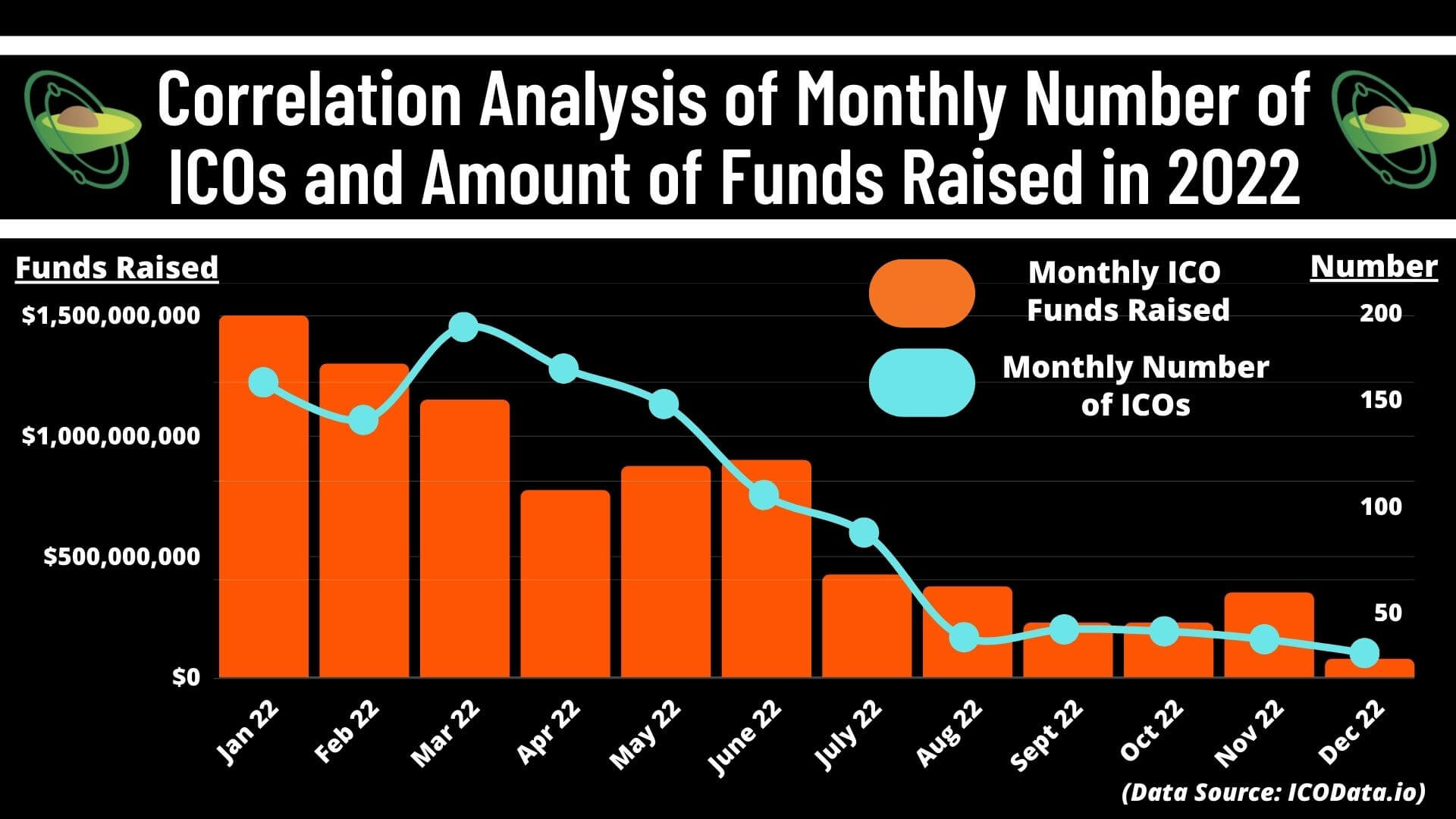

Since then, the number of ICOs and the number of funds raised by these offerings have fallen by the wayside. With ICO fading into oblivion, it was later replaced by alternative crypto crowdfunding mechanisms such as Initial Exchange Offerings (IEOs) and Initial Decentralized Offerings (IDOs).

ICO Statistics for 2022 (Source: Avocado DAO)

ICO Statistics for 2022 (Source: Avocado DAO)

Having learned its lessons from the demise of ICO, the crypto market introduced the crypto crowdfunding concept of IEO. The idea behind the advent of IEO is to warrant investor protection through centralized exchanges (CEXs) as host platforms for IEOs. These host exchanges are tasked with vetting the legitimacy of the proprietor of a proposed IEO and the viability of the underlying project of the IEO. In this manner, the host exchanges serve as trust anchors by acting as assessors of the IEOs launched through their platforms.

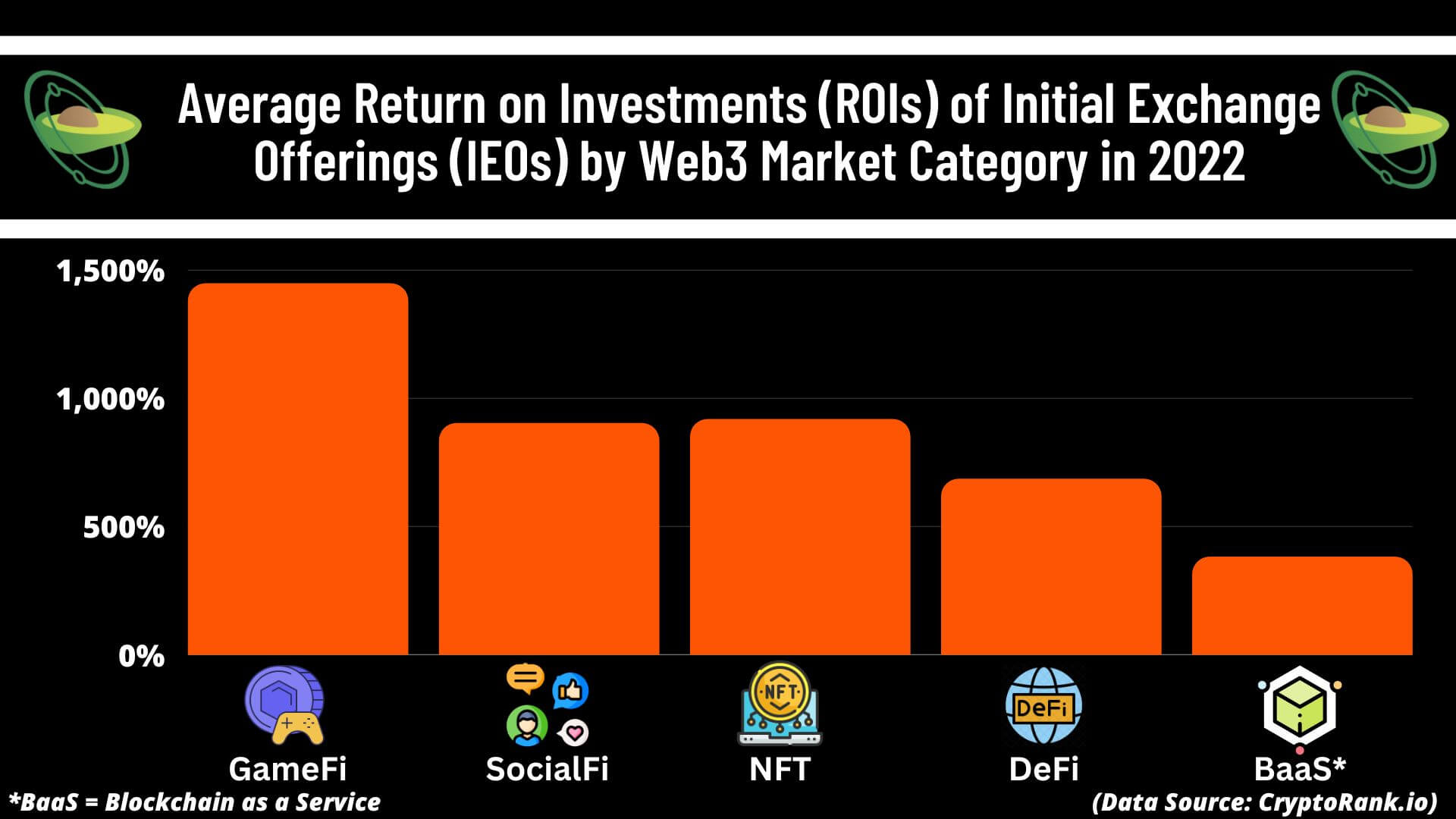

In return for putting their reputational scores on the line as they underwrite the risks of the IEOs hosted on their platforms, the host exchanges are rewarded with listing fees that could go up to a million bucks for reputable top exchanges. In 2022, there were a total of 165 IEOs, with the top 5 most popular CEX hosting platforms being Gate.io Startup (97), Huobi Primelist (25), Bybit (15), as well as KuCoin Spotlight and Bitforex Turbo Starter with seven each. In terms of Web3 market categories, GameFi IEOs led the way with an average Return on Investment (ROI) of about 1,500% in 2022.

Average ROIs of IEOs in 2022 (Source: Avocado DAO)

Average ROIs of IEOs in 2022 (Source: Avocado DAO)

The use of CEXs as gatekeepers for the IEOs hosted on their platforms was able to address the risks of crypto crowdfunding scams. However, the centralized structure of IEO frameworks was an aberrant departure from the decentralized ideals of cryptocurrencies. This issue gave rise to IDO, whereby the role of exchanges as gatekeepers were replaced by community members as watchdogs.

How it works is that instead of CEXs evaluating the legitimacy of the proprietors of the token issuers and the viability of the underlying projects, this is done by community members of a DEX protocol. The governance token holders of a decentralized protocol would vote on the IDO projects proposed to be hosted on the protocol’s DEX.

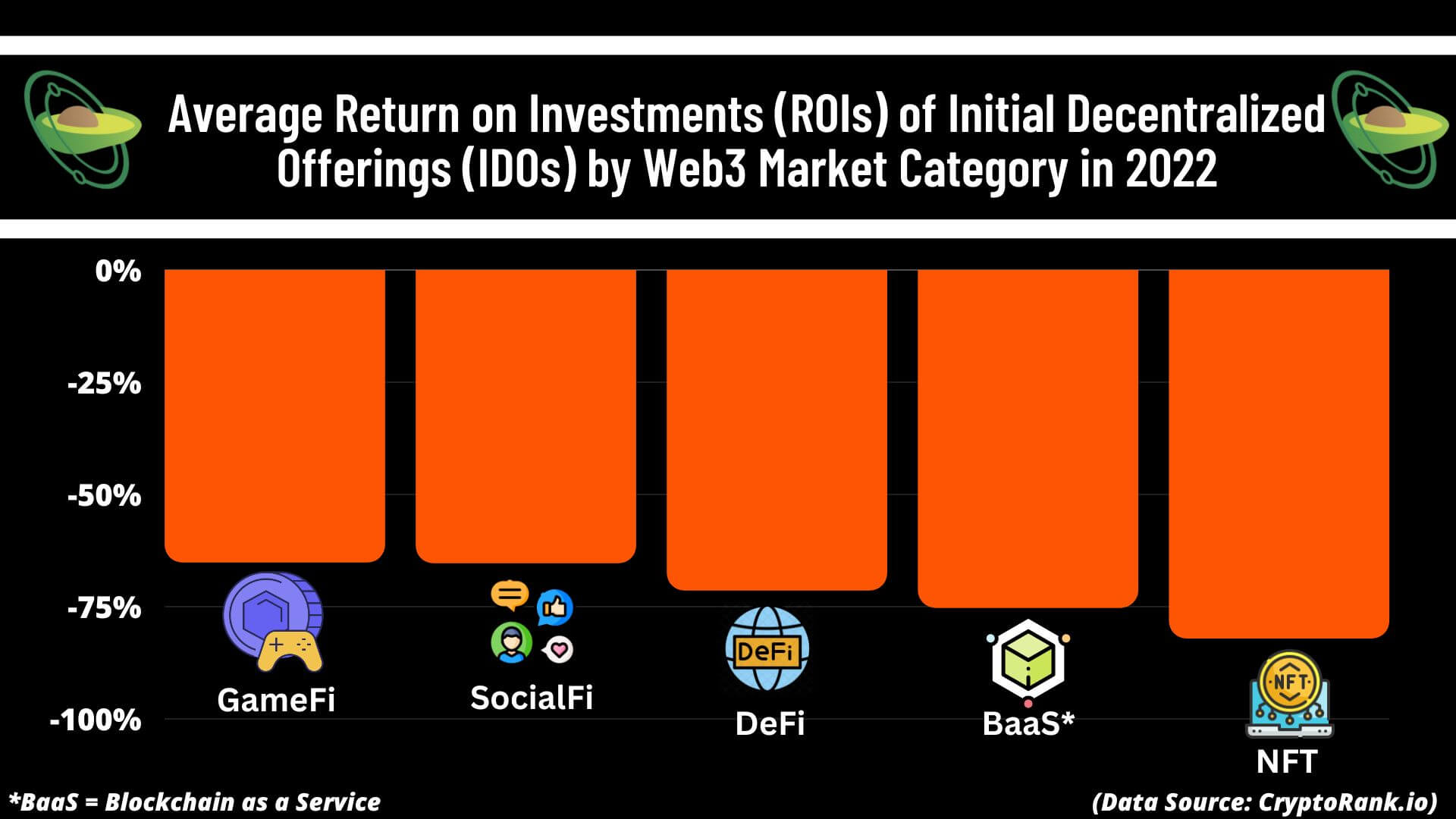

Not only is this more in line with the decentralization ideals of cryptocurrencies, but it is also more transparent. This element of transparency is because the IEO listing requirements of CEXs tend to be opaque due to their public inaccessibility. In 2022, there were a total of 373 IDOs, with the top 5 most popular DEX hosting platforms being Kommunitas (42), MoonStarter (29), EnjinStarter (28), TrustPad (25), and GameStarter (24). IDOs across the top five Web3 market categories recorded negative average ROIs in 2022.

Average ROIs of IDOs in 2022 (Source: Avocado DAO)

Average ROIs of IDOs in 2022 (Source: Avocado DAO)

Besides IEO and IDO, there are a host of other crypto crowdfunding mechanisms such as Decentralized Autonomous Initial Coin Offerings (DAICO), Initial Bounty Offerings (IBO), Security Token Offerings (STO), Initial Game Offerings (IGO), Initial Liquidity Offering (ILO), Initial NFT Offering (INO), Initial Farm Offering (IFO), Initial Stake Pool Offering (ISPO)), Strong Holder Offering (SHO) and Wallet Holder Offering (WHO). Each of them has something distinctively unique to offer for Web3 financing.

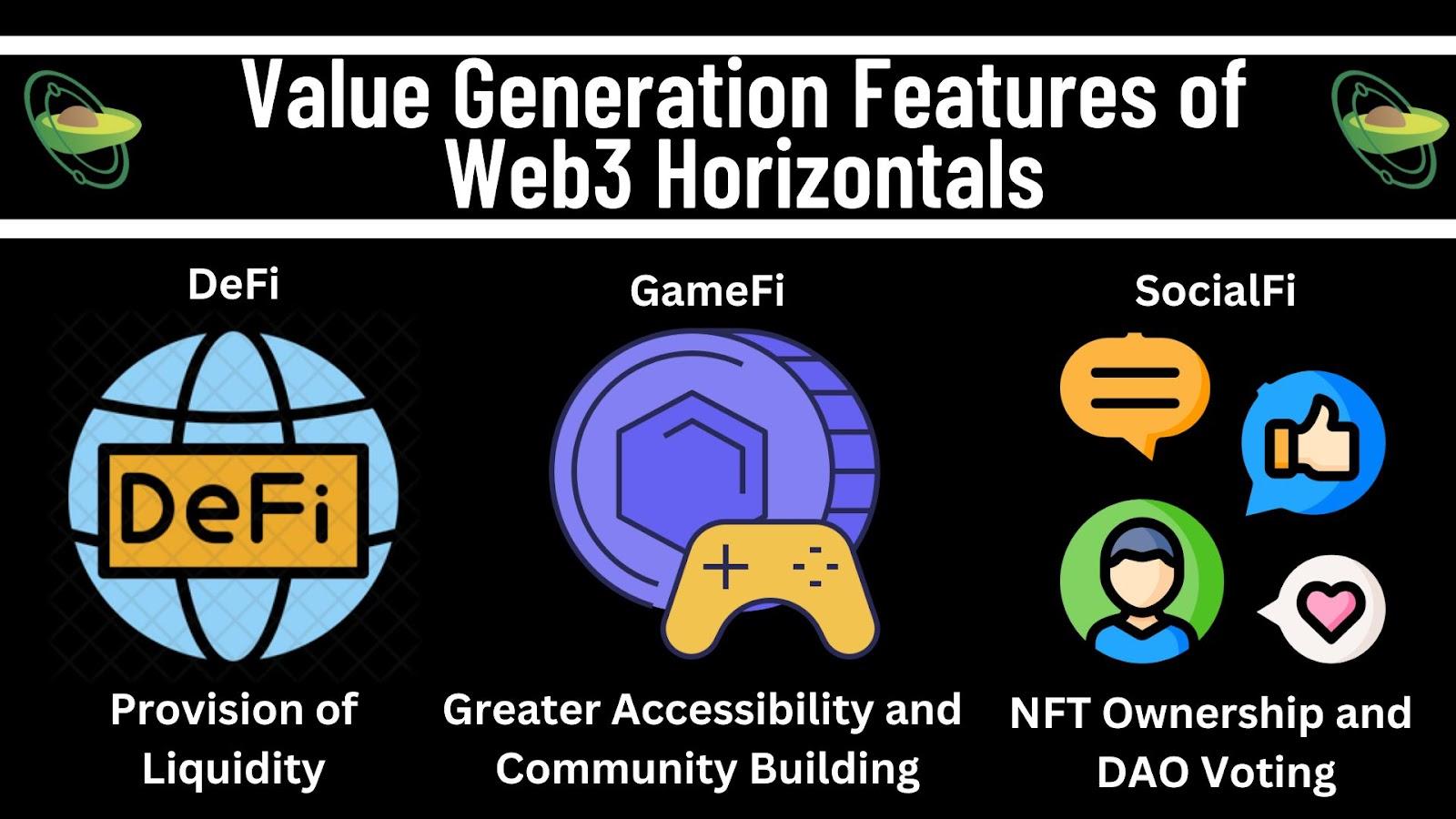

Value Generation Through Web3 HorizontalsVenture capitalist (VC) and crypto crowdfunding investments for Web3 are all well and good. However, if Web3 investments are to be commercially sustainable, the business models of its platforms must entail value generation instead of merely the element of value transfer in the following horizontals.

Decentralized Finance (DeFi)The provision of liquidity warrants the element of value generation in DeFi. The key to sustaining any business startup, including Web3 projects, is having sufficient liquidity. Through the Proof-of-Stake (PoS) model of DeFi, Web3 projects can secure liquidity through the automated market model (AMM) frameworks of DeFi protocols. How it works is that token holders of a Web3 project can contribute to the project’s liquidity by depositing and locking their tokens in the relevant liquidity pools of DeFi protocols.

In return, token holders who stake their tokens would receive staking rewards in the form of interest receipts that usually take the form of staked tokens. For example, Avocado DAO (AVG) tokens can be staked for returns with annual percentage rates (APRs) of up to 100%. Talking about generating passive income, Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.”

Gamification (GameFi)The element of value generation of GameFi is heralded by the arrival of GameFi 2.0. This new and improved version of GameFi entails lowering the barriers to entry for GameFi projects. A case in point is Axie Infinity Origins which provides new players with three free Axies. This free-to-play model contrasts with Axie Infinity Classic, which requires new players to buy their first Axies to play the game. The replacement of Classic with Origins in June 2022 signifies the end of an era for GameFi 1.0, which was replaced with GameFi 2.0. With this, the door to the GameFi domain is open to all.

In addition to lowering the barriers to entry, GameFi 2.0 also entails the shifting of focus from profit-making to community building. In other words, whereas GameFi 1.0 was focused on attaining financial rewards, GameFi 2.0 is focused on something more meaningful through the forming of social connections, which brings a sense of belonging to community members. Leading the way for GameFi 2.0 is Avocado DAO, whose Discord community has about 94k members as of February 2023.

Social Finance (SocialFi)The element of value generation of GameFi stems from the ownership and creator economies of Web3. In essence, the concept of SocialFi entails rewarding Web3 users for creating, sharing, and transferring user-generated content (UGC). After creating their UGC, creators can share this content with fellow Web3 users. The rankings of UGC would be determined through upvotes and downvotes under a Decentralized Autonomous Organization (DAO) framework. Rewards in the form of SocialFi tokens would be given to creators based on the reception of their UGC among members of the Web3 community in which the content was shared.

To top it all off, members of a Web3 community can acquire ownership rights to UGC shared in the community. The use of non-fungible tokens (NFTs) for the tokenizing of UGC enables the creators of this content to fully own their UGC creations. In line with the community-centric nature of Web3, creators of UGC can transfer their ownership rights to these UGC to their fellow Web3 users in return for SocialFi tokens of the community to which they belong.

Web3 Value Generation (Source: Avocado DAO)

Web3 Value Generation (Source: Avocado DAO)

The embracing of the concept of value generation through its horizontals of DeFi, GameFi, and SocialFi enhances the sustainability of Web3’s financial framework. This concept would strengthen the interlinkages of Web3’s financial framework with the real money economy, thereby shoring up the foundations and long-term viability of the Web3 domain.

ConclusionFor all the conceptual ideals of Web3, the realization of these ideals hinges on the commercial viability and business sense of Web3’s financial framework. The high inflow of VC investments is a testament to investor confidence in Web3 projects, whereas the various crypto crowdfunding mechanisms serve as alternative financing channels for these projects. Lastly, the value generation features of Web3’s DeFi, GameFi, and SocialFi horizontals substantively validate the dollars and cents of Web3.

This course draws to a close our beginner curriculum for Web3 users. If you’re interested to learn more about Web3, do look out for our intermediate curriculum that would feature a deeper dive into the next generation of the Internet.