Crypto regulations have been a perennial topic since the advent of Bitcoin. On one side of the coin, the imposition of regulations could reduce the risks of cryptocurrencies being misused for money laundering and other illegal purposes. On the other side of the coin, the imposition of regulations could have the effect of stifling the development of a relatively nascent industry. In terms of regulatory approaches, they can be generally categorized as follows:-

(a) Outright prohibitionThis approach entails the imposition of a total ban on all forms of crypto-related activities. An example of a country which has adopted this regulatory approach is China.

(b) Selective prohibitionThis approach entails the imposition of a ban on certain types of crypto-related activities while allowing others. An example of a country which has adopted this regulatory approach is Indonesia where crypto payment is banned but crypto trading is permitted.

(c) Hands offThis approach entails the adoption of a laissez-faire i.e. a free market approach to crypto regulation with the aim of doing no harm. Examples of countries which has adopted this regulatory approach are the Mediterranean countries of Cyprus and Malta.

(2) The Regulatory LoopholesUp to this point, a lack of streamlined regulations have enabled crypto entities to harness the borderless nature of cryptocurrencies to skirt existing regulations and sidestep regulatory oversight of the countries in which they operate. A common practice among crypto entities is that of regulatory arbitrage which involves “utilizing more favourable laws in one jurisdiction to circumvent less favourable regulation elsewhere.” Case in point is FTX which had in September 2021 shifted its headquarters from Hong Kong to Bahamas to capitalize on the offshore regulations of Bahamas which are relatively less stringent than those of Hong Kong.

Regulatory Arbitrage (Source: Investopedia.com)

Regulatory Arbitrage (Source: Investopedia.com)

Another common practice among crypto entities is that of regulatory buyouts which involves acquiring other crypto entities that are already licensed in the jurisdictions which the buying crypto entity is looking to obtain a license in. For example, crypto entity A wants to obtain a license to operate in country B but for one reason or another is unable to do so. What crypto entity A would do is to buyout crypto entity C which is licensed to operate in country B. In this manner crypto entity A would have control over the license of crypto entity C, thereby enabling crypto entity A to effectively be licensed to operate in country B, albeit through the backdoor.

Case in point is FTX which prior to its collapse had spent some USD2 billion on “acquisitions for regulatory purposes.” A notable example of such an acquisition by FTX is that of U.S-based crypto futures exchange, LedgerX in October 2021 . The acquisition of LedgerX (which was rebranded as FTX US Derivatives post-acquisition) allowed FTX to take control of three Commodities Future Trading Commission (CFTC) licenses, thereby enabling FTX to effectively be a regulated player in the U.S commodities derivatives market. Nonetheless, LedgerX is not the first let alone only acquisition for regulatory purposes by FTX.

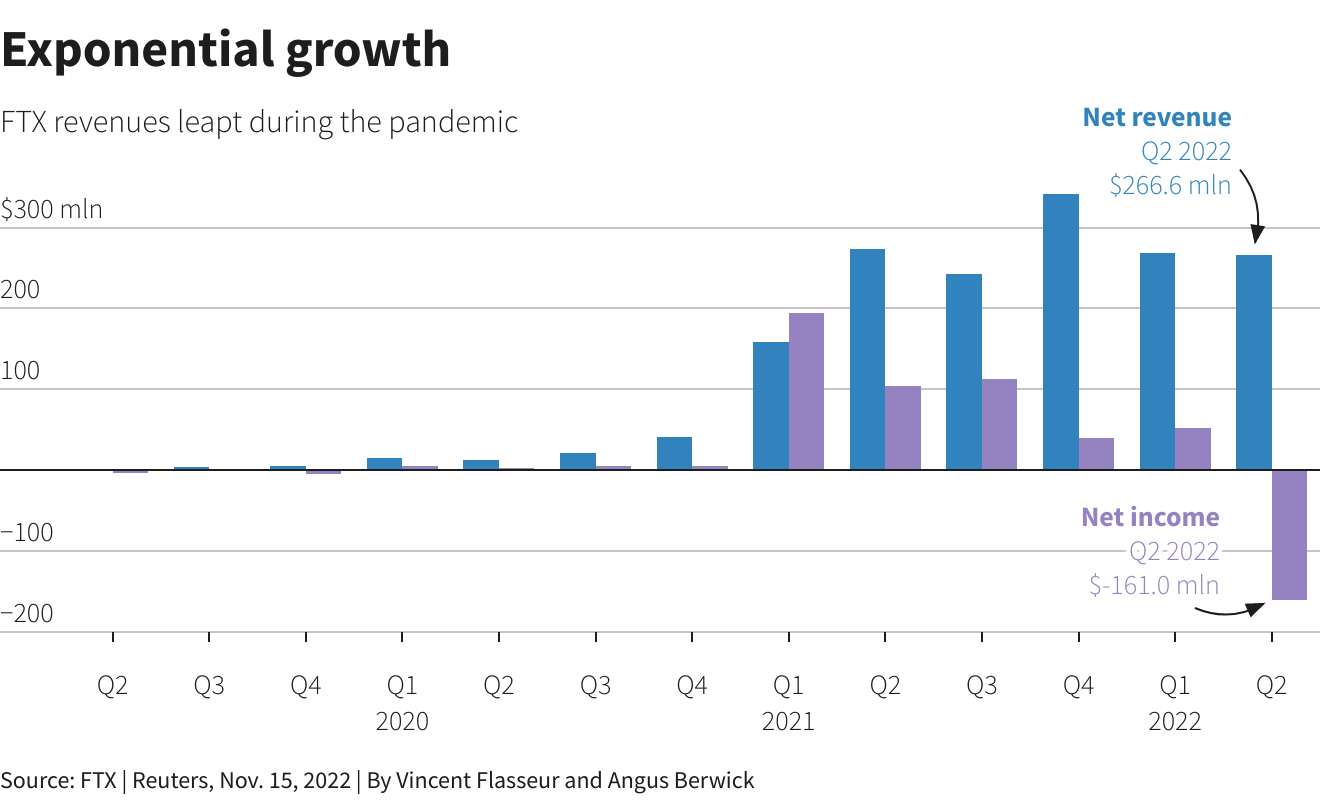

Back in April 2021, FTX had entered into a commercial agreement to acquire an 8% stake in South African crypto exchange, OVEX. This acquisition comes after the local authorities had issued a public advisory to warn that FTX is not licensed to operate in the country. From a financial perspective, FTX’s exponential growth since the first quarter of 2021 (Q1 2021) due to the massive spike in its revenue during the pandemic is what gave the fallen exchange the financial prowess to undertake these acquisitions for regulatory purposes.

FTX’s Revenue from Q2 2020 to Q2 2022 (Source: Reuters.com)

FTX’s Revenue from Q2 2020 to Q2 2022 (Source: Reuters.com)

In many ways, the loopholes in the existing crypto regulations enabled FTX to put up a front of being pro-regulation and conjure the illusion of itself as the "most regulated" exchange on the planet. As things turn out, FTX is nothing more than a crypto house of cards built on the loopholes in the existing regulations. These loopholes have enabled FTX to hide under the regulatory veil to undertake various fraud and conspiracy activities as set out in the U.S’ grand jury indictment charge sheet as follows:-

(a) Conspiracy to commit wire fraud on customers

(b) Wire fraud on customers

(c) Conspiracy to commit wire fraud on lenders

(d) Wire fraud on lenders

(e) Conspiracy to commit commodities fraud

(f) Conspiracy to commit securities fraud

(g) Conspiracy to commit money laundering

(h) Conspiracy to defraud the U.S and violate campaign finance laws

(3) The Regulatory RemediesIf anything, the FTX fallout has indicated that there is a palpable need for the introduction of crypto regulations which pack more of a punch. Leading the global charge in this direction is Europe’s Financial Stability Board (FSB) which is taking the bull by the horns through its plans to introduce recommendations for crypto regulations in early 2023. Laying the groundwork for its recommendations, the FSB had in October 2022 issued its proposed framework titled “International Regulation of Crypto-asset Activities.” With this, let’s explore how FSB’s recommendations can help address the corporate governance and risk management failures which resulted in the FTX fallout:-

(a) Same activity, same risk, same regulationsThe FSB recommends that “Where crypto-assets and intermediaries perform an equivalent economic function to one performed by instruments and intermediaries of the traditional financial sector, they should be subject to equivalent regulation. This is true regardless of how a particular crypto-asset is characterized (e.g., as a payment, security or other instrument).”

The application of this recommendation would have meant that FTX (as opposed to its subsidiaries) would have been subjected to the same regulations for financial institutions and investment companies. Financial institutions are generally subjected to banking laws (for FTX’s deposit taking activities) whereas investment companies are generally subjected to securities and commodities laws (for FTX’s facilitating of the trading of cryptocurrencies with features of securities and commodities). In effect the application of these laws to FTX would have mitigated the risks in relation to the charges of wire fraud, commodities fraud, securities fraud and money laundering.

In relation to banking laws, the imposition on FTX of the transparency requirements for the maintenance and publication of audited accounting records and financial statements would have mitigated the risks of the commission of wire fraud and money laundering. As for securities laws, the imposition of FTX of the requirements for clients' assets protection which entail among other things the need to segregate clients' assets by storing these assets in a designated trust account would have mitigated the risks of the commission of commodities and securities fraud.

(b) Adequate requirements for governance, risk management, reporting and disclosureThe FSB recommended that “Authorities should, consistent with their respective mandates, have the capacity to identify and monitor interlinkages between the crypto-asset ecosystem and the traditional financial system and cooperate and exchange information with their foreign counterparts to identify and address cross-border spillovers and risks.”

In the context of traditional financial institutions such as banks, they are generally subjected to some basic parameters which they need to adhere to as part of their governance and risk management frameworks. For example, the Basel III standards stipulate that banks must maintain a minimum Capital Adequacy Ratio (CAR) of 8% to help banks withstand any stressors in the economic and financial markets. In simple terms, CAR refers to a bank’s ability and available financial buffers to cover for a significant loss from economic downturns or financial crisis.

The inclusion of the need to maintain a base level for metrics such as CAR as part of the governance and risk management frameworks of crypto entities would reduce their systemic instabilities in times of high market volatility. With the benefit of hindsight, perhaps this could have prevented the FTX fallout which was due in no small part to the prolonged crypto winter that laid bare the fault lines in the management framework and fiscal discipline of FTX.

Moreover, the imposition of disclosure and reporting obligations on FTX could have prevented the misappropriation of USD10 billion of customers’ funds by the former CEO of FTX, Sam Bankman-Fried aka SBF who transferred these funds to Alameda Research which is the sister trading firm of FTX. Additionally, the imposition of these obligations could have also prevented the further misappropriation of USD40 million of customers’ funds for political donation purposes which led to the charge against SBF of conspiracy to defraud the U.S and violate campaign finance laws.

(c) Cross-border cooperation, coordination and information sharingThe FSB noted that “The cross-border nature of crypto-assets raises regulatory, supervisory and enforcement challenges. Jurisdictional differences in legal and regulatory frameworks and supervisory and enforcement outcomes underscore the potential for regulatory fragmentation and arbitrage without cross-border cooperation and information sharing consistent with authorities’ respective mandates and jurisdictional requirements.”

The application of this recommendation would have discouraged FTX from harnessing its financial prowess to resort to regulatory arbitrage by shifting its headquarters from Hong Kong to the Bahamas. This is because the cross-border cooperation, coordination and information sharing among regulators from different jurisdictions would have meant that the long arm of the law would have reached FTX regardless of where it based its headquarters. Additionally, it would also have discouraged FTX from undertaking its string of acquisitions for regulatory purposes. Effectively this meant that FTX would not have been able to buy its way to become the “most regulated exchange” by leveraging the regulatory fragmentation across the different jurisdictions.

(4) The Market ImpactGiven the close interlinkages between FTX and Solana, it was rather unsurprising that the blockchain ecosystem has been hit hard by the FTX fallout. When FTX halted all crypto withdrawals on 9 November 2022, Solana Foundation’s roughly 3.43 million FTX (FTT) tokens and 134.54 million Serum (SRM) were trapped in the exchange with Solana’s group holdings of 3.24 million shares of FTX common stock further worsening its exposure to FTX which amounted to an estimated total of USD 180 million. As a result of Solana’s exposure to FTX, the total value locked (TVL) in the Solana blockchain dropped by more than 80% to about USD230 million as at the time of writing whereas its native token SOL lost 53% of its market value in the wake of the FTX fallout.

Solana’s TVL Chart (Source: DefiLlama.com)

Solana’s TVL Chart (Source: DefiLlama.com)

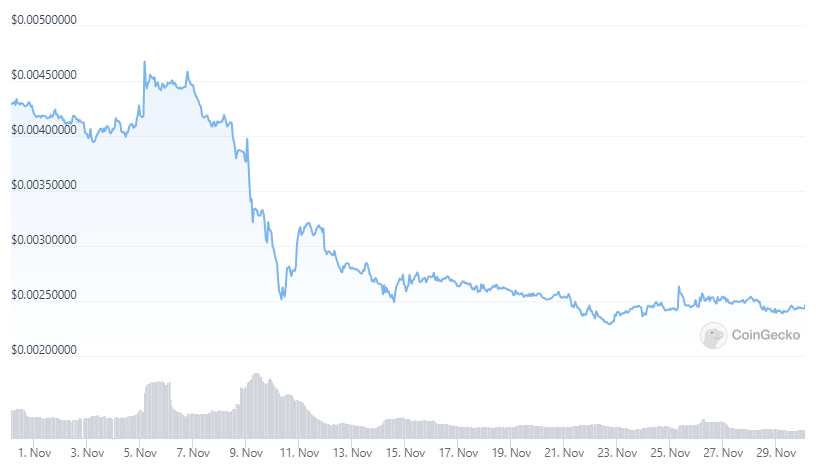

One of the Solana-based GameFi projects which has been significantly affected by the FTX fallout is the Aurory RPG whose token AURY has dropped by about 50% in price from 11 Nov 2022 to date. Another Solana-based GameFi project which has borne the brunt of the FTX fallout is TapFantasy whose token price has dropped by about 10% from 11 Nov 2022 to date though its unique active wallets (UAW) and transaction volume have since rebounded. Nonetheless, the hardest hit Solana-based game is Star Atlas whose token ATLAS has lost about half its value from 11 Nov 2022 to the end of the month.

ATLAS’s Price Chart (Source: CoinGecko.com)

ATLAS’s Price Chart (Source: CoinGecko.com)

That said, the GameFi’s market metrics such as UAW and transaction volume have remained more or less stable since the FTX fallout as other gaming chains such as EOS, Hive, Wax, Ronin and IMX are relatively unaffected by the FTX fallout. Standing testament to this is the fact that GameFi still remains the blockchain market segment with the largest UAW and highest transaction volume over the last 30 days.

(5) ConclusionIf there is to be a silver lining to the FTX fallout, it is that it has pointed out the pressing need for crypto regulations to bring an end to the wild west days of the market. Fact of the matter is that the chain of events in the crypto market over the course of 2022 has aptly illustrated that the anti-crypto regulation stance is doing the market more harm than good. As we look set to end the year on a gloomy note for the crypto market, the best Christmas gift for true blue crypto enthusiasts may be the introduction of regulations which could mitigate the risks of another major collapse or fallout that in all probability may be the final blow that could wipe out the market.

OTHER POSTS THAT YOU MIGHT LIKE

A Deep Dive into the Depths of the Dungeons of Apeiron’s Battle Demo

A Deep Dive into the Depths of the Dungeons of Apeiron’s Battle Demo Tiny Tap: A Web3 Platform that rewards childhood educators and content creators with digital ownership

Tiny Tap: A Web3 Platform that rewards childhood educators and content creators with digital ownership Illuvium Course 3: Be the Gladiator of the Illuvium Arena

Illuvium Course 3: Be the Gladiator of the Illuvium Arena Breaking AvoNewsFlash: Fall of Silvergate Bank, Silicon Valley Bank and Signature Bank

Breaking AvoNewsFlash: Fall of Silvergate Bank, Silicon Valley Bank and Signature Bank